The continuation of the Covid-19 pandemic has generated a phenomenon of social insecurity, albeit faced with a substantial recovery that has marked the national, European and world scene. At two years since the emergency first started, in fact, most countries are finding themselves addressing a series of peaks in the health emergency, alternating with less critical periods. The pandemic has speeded up a whole series of evolutions in how companies work, as they found themselves forced to innovate to adapt quickly to the changes. In this scenario, Italgas showed exceptional resilience, guaranteeing continuity of service to around 8 million customers in Italy, while at the same time allowing its people to operate in complete safety.

Precisely in this situation of extraordinary unpredictability, Italgas gathered its first results on the digital transformation of processes, assets and people launched in 2017. Investments in digitisation have allowed, from the very start of the pandemic, for work to be reorganised and all activities carried out from a remote position. Still today, the presence in the company office is alternated with long periods spent working from home, to guarantee maximum employee safety. In addition, thanks to the development and application of innovative technologies, such as “ShareView” and “WorkOnSite”, it has become possible to efficiently manage the network from a remote position, reducing the number of trips to the field and, consequently fuel consumption and CO2 emissions.

Recording twenty consecutive quarters of growth since its return to the stock exchange, Italgas has shown itself capable of continuing its development and transformation even during the health emergency, supporting the country’s economic fabric, contributing to the economic recovery thanks to important investments and playing a lead role in the energy transition.

The major rise in energy prices seen during the latter months of 2021, was caused by a combination of factors – first and foremost geopolitical – which has generated further instability on a European level. This situation, which is putting numerous industrial segments very much to the test in Italy, has led to a reflection on the investments necessary to achieve energy independence for the country. In this context, renewable gases – biomethane first and foremost – have very significant potential, not only in terms of the decarbonisation of consumption but also to guarantee greater security of procurement.

The gas networks are a strategic asset by which to stimulate renewable gas production, as long as they are entirely digitised and flexible, i.e. able to transmit data, receive and execute instructions, be managed from a remote position. Comparisons within national and international trade associations, thanks to the digital transformation undertaken, find that Italgas is the first gas distribution company in the world with an entirely digitised network.

The company is working on numerous innovative projects aimed at driving the integration of renewable gases in the country’s energy mix.

After the major slow-down last year, 2021 saw a rapid recovery of the GDP (gross domestic product) and employment levels worldwide, thanks to the progressive reopening of economic activities and the support supplied by the monetary and tax authorities. This is confirmed by the GDP growth for the US, Europe and Italy, coming in respectively at 5.7%, 5.2% and 6.5% for 2021. At the same time, the Purchasing Managers Index for the US manufacturing sector reached all-time highs, while initial unemployment applications in the United States have dropped to the lowest level seen in more than 50 years.

The major recovery of economic activities, coupled with the rising pressure on prices of energy commodities, due to growth in demand that exceeds supply, have given rise to a major price increase and, accordingly, inflation. This increase intensified in particular towards year end. In December, US inflation rose to 7.0% as compared with the same month of 2020, to the peaks recorded in 1982, while German inflation came to 5.3%, a high since 1992.

Despite the rise in inflation, central banks maintained an approach that was generally accommodating, in support of the economy. It was only at year end that they decided to proceed with a gradual withdrawal of monetary stimuli. More specifically, the FED initially announced in November the progressive reduction of 15 billion dollars a month of the QE (Quantitative Easing) and during the following meeting held in December, it doubled the monthly purchase reduction plan to 30 billion dollars, so as to zero QE in March 2022. The FED has also declared its expectation to raise the rates three times in 2022.

After having intensified the PEPP (Pandemic Emergency Purchase Programme) in the 2nd and 3rd quarters, during the December meeting, the ECB instead announced the end of this programme as from end March 2022, with its temporary substitution, for a total of 6 months, with the strengthening of the APP programme (Asset Purchase Programme).

Despite the considerable increase of inflationist forecasts, the central banks’ policy compressed real bond yields on new alltime lows, with a consequent limited rise in nominal yields. The German 10-year nominal yield rose by 39 bps (from -0.57% to -0.18%) with the real component declining by 59 bps (the new all-time low was recorded mid-November: -2.26%) and implicit inflation rising by 98 bps. In the case of the US Treasury, the increase in the nominal yield was even more marked (+60 bps; from 0.91% to 1.51%), reflecting the less accommodating approach of the FED and the more dynamic US economy, with the variation entirely brought about by inflationist forecasts, whilst the real component was generally stable at all-time lows (in this case too, the new low was recorded in November: -1.20%). The BTP-Bund spread showed a moderate rise (+24 bps, i.e. from 111 to 135 bps), entirely concentrated in the last two months of the year as a reflection of expectations for a gradual withdrawal of monetary stimuli by the ECB in order to mitigate the inflationist dynamic consequent to the overheating of the economy.

The performance of currencies reflected the different expectations in terms of timing for the normalisation of monetary policies by the various central banks. In 2021, the EUR/USD depreciated by 7% (to 1.14, close to the lows since June 2020) and the EUR/GBP drew back by 6% (to 0.84, lowest since February 2020).

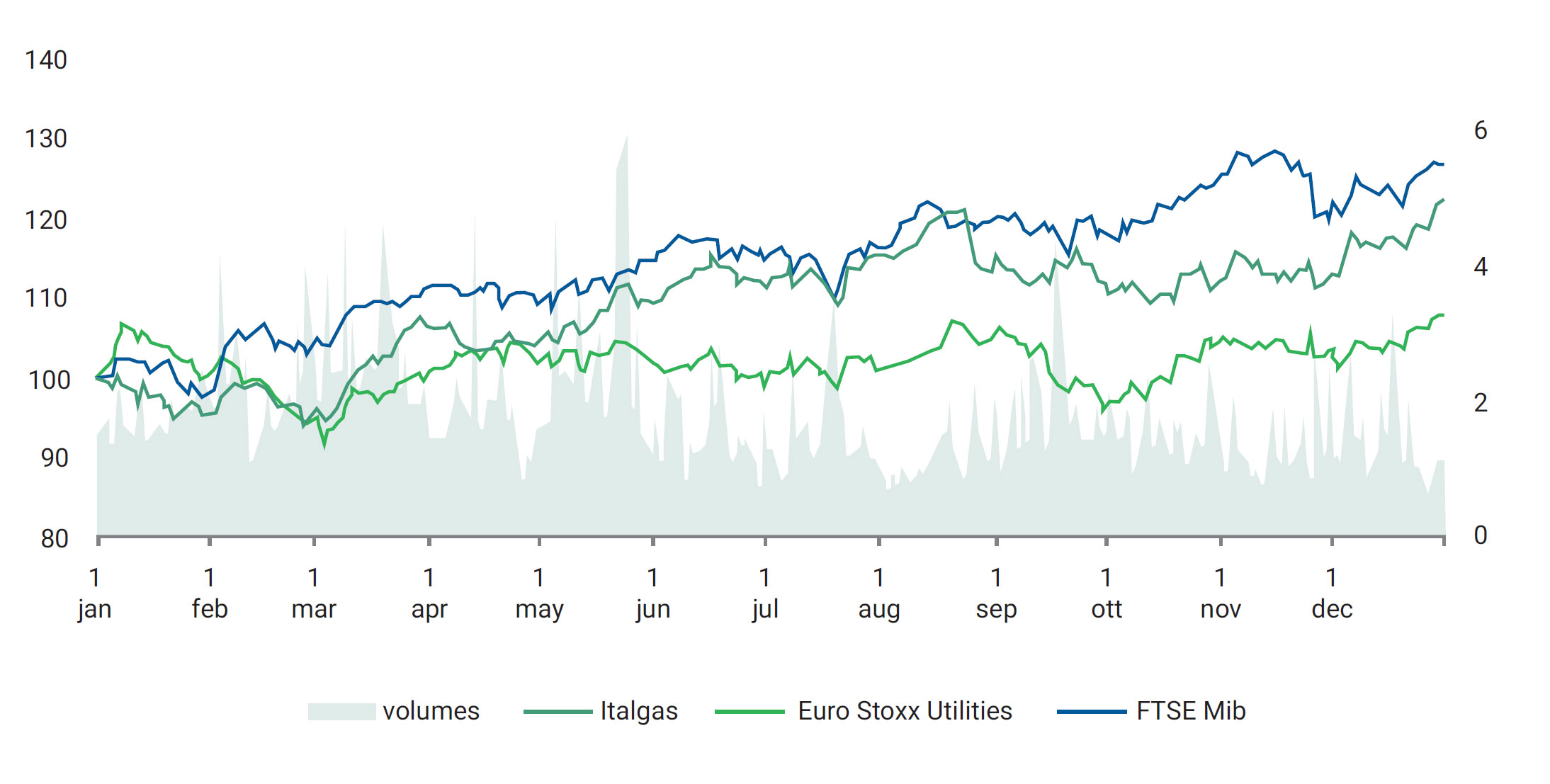

With the progressive reopening of economic activities and support by the monetary and tax authorities, the main world share indexes recorded major rises in 2021, extending the all-time highs. With prices adjusted for dividend payments and reinvestments (total shareholder return), the Euro Stoxx share index rose by 23.5%. The US S&P 500 index improved by +28.7% thanks to the greater exposure to technological securities, which, together with the banking sector, were the best of the list. Faced with an economic recovery that was fairly homogeneous in the various countries of the Eurozone, the difference in yield between the various national share indexes reflected exposure to the specific economic sectors. With a rise of 31.9%, the French CAC 40 share index was the best, thanks to the exposure to the fashion & luxury segment, which benefited from the major recovery of sales worldwide and particularly in China. This was followed by the Italian FTSE Mib (+26.8%), which benefited from exposure to the bank segment and the production of semi-conductors. Further off, is the German DAX index (+15.8%) and the Spanish Ibex 35 (+9.4%), with the latter penalised by its high exposure to the utilities sector, the worse of the list.

Despite the support given by the energy scenario, the Euro Stoxx Utilities only rose by 7.9%, coming in fourth-to-last of the European sector indexes, penalised by fears over legislative interventions aiming to mitigate the impact on end users of the rise in gas and electricity prices, with a negative impact on the profits of the integrated operators. The banking and technological segments performed best on the Eurozone market, the first due to the improved economic scenario and major rise in inflation, the second thanks to the digitisation process underway in a great many sectors, which resulted in a world shortage of semi-conductors. The defensive sectors (real estate and retail) were the worst in terms of return, due to the improved macroeconomic context.

The Italgas share closed 2021 at € 6.052 per share. Considering the dividend of € 0.277 per share issued in May 2021 and a price at end 2020 of € 5.20, it recorded a total shareholder return (with reinvestment of the dividend) of 22.2%.

From the date on which it was listed in November 2016 to 31 December 2021, the total shareholder return is 91.2%.

During the year, the average daily trading volume of the Italgas stock on the Italian Stock Exchange electronic market was about 1.9 million shares, with a greater concentration of trades around the announcement of quarterly results, the ex-dividend date and updating of the 2021-2027 Strategic Plan, presented mid-June 2021.