Italgas invests in the territories in which it operates, promoting social, cultural and environmental interventions based on criteria of transparency, correctness and impartiality. The company promotes the development and cohesion of the communities in which it works, acknowledging the central role played by stakeholders and their needs, to create social value that goes beyond the economic value.

The Company is constantly committed to assuring direct, continuous dialogue with the communities in which it works and, to contribute to their social and cultural development, has equipped itself some time ago with a structure specifically dedicated to this end.

Furthermore, the Groups collaborates with bodies, associations and foundations, no-profit organisations and other parties in the area to give rise to events, projects and ventures in favour of the protection of the environment, the spread of culture, technological and scientific innovation, research and training.

To better manage relations with the territory and its activities of dialogue with and listening to stakeholders, the Group adopted its Corporate Citizenship Policy, which was updated during the year. In the framework defined in the Group’s Code of Ethics on the general principles of transparency, honesty, fairness and good faith, the Policy assigns clear responsibilities in terms of the management of donations, sponsorships and territorial projects.

Through this Policy, the Group has confirmed and formalised its commitment to the following areas of intervention:

By supporting the initiatives on the territory, Italgas aims to strengthen its contribution to meeting specific Sustainable Development Goals (SDGs), constituting the 2030 Agenda of the United Nations.

In 2021, Group donations to the value of € 324.4 thousand were made, intended mainly for art and culture.

Italgas traditionally supports, as a member, two important organisations in Turin, the company’s home city and current registered offices of Italgas Reti:

Furthermore, Italgas supports the Fondazione Giorgio Cini in Venice, an internationally recognised centre for culture, research, exhibitions and conferences, shows and concerts.

The Italgas Heritage Lab also collaborates with various institutes of the Fondazione, including ARCHiVe Analysis and Recording of Cultural Heritage in Venice.

Of the Group companies, Toscana Energia is a member of the foundations of two important theatres in the territory where it operates:

In 2021, the Italgas Group activated sponsorship initiatives worth € 969,483 mainly aimed at art, culture and sport.

The management of sponsorships and donations follows a formalised process governed by specific internal procedures, in particular:

| Sponsorships and donations | U.o.m. | 2019 | 2020 | 2021 |

| Sponsorships | k€ | 671 | 1,086 | 970 |

| Liberal donations | k€ | 26 | 2,02947 | 324 |

| Total | k€ | 697 | 3,115 | 1,294 |

47 86% of the liberal disbursements activated by the Group in 2020 consisted of donations to various hospitals for the purchase of machinery, equipment, and functional garrisons (such as devices for the protection of health facility personnel, inpatient beds and technical equipment) and contributed to the setting up of new areas to meet the needs arising from the emergency situation related to the pandemic and ensure hospital service.

Due to the continued Covid-19 containment measures, support for the initiatives in terms of education on energy, usually envisaged with the physical involvement of participants, has slowed. In spite of this, in Sardinia and Tuscany the initiatives dedicated to the world of education continued.

The 2020/2021 educational project was dedicated to primary schools for the first time. The “Disegna la tua energia!” [Draw your energy!] contest proposed a creative activity with the objective of bringing young students closer to the various sources of renewable and non-renewable energy, educating them on their sustainable and informed use. At the end of the course, the children used drawings to express their idea of energy and the winning classes were awarded teaching materials.

Italgas and Medea also participated this year in the LaNuova@Scuola project implemented by the newspaper, La Nuova Sardegna, to develop opportunities for information and training in the field dedicated to students and teachers from Sardinian schools.

The virtual event with more than 500 students was attended by senior figures from Italgas and Medea to provide information about the energy and gas distribution sector, to develop relations between the company and schools, to promote the development of talent and to support guidance around decisions about transitioning to university or looking for a job.

The statement determining and breaking down Economic Value, generated directly by the Group, has been prepared reclassifying the consolidated profit and loss account as envisaged by the GRI Standards and distinguishing between three levels of economic value: that generated/produced, that distributed and that withheld by the Group.

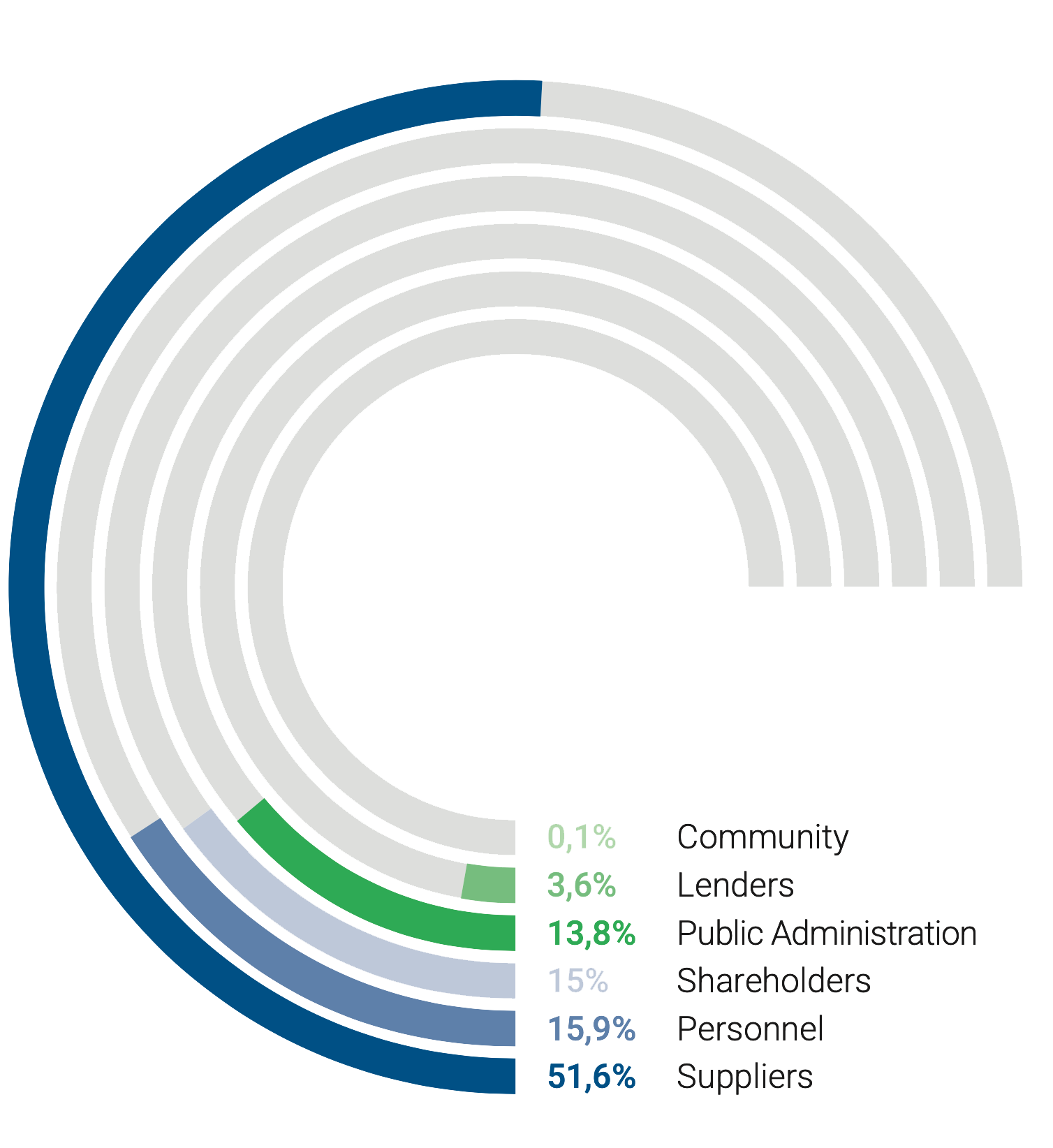

The economic value represents the comprehensive wealth created directly by the Group, which is thereafter split between the various stakeholders: suppliers, employees, lenders, shareholders, Public Administration and general public.

In 2021, the value generated by the Group was € 2,247.2 million (+6.7% on 2020).

Of this, € 566.1 million have been kept in the company and € 1,681.1 million have been distributed to stakeholders. Specifically, of the total value distributed, 51.6% went to suppliers (€ 867.5 million), 15.9% to employees (€ 267.4 million), more than 15.0% to the shareholders (€ 252.9 million), approximately 13.8% to the Public Administration Authorities (€ 232.5 million) and 3.6% to lenders (€ 59.5 million). 1.3 million were allocated to the general public, a decrease compared to the extraordinary portion allocated last year, mainly to support the health sector with the Covid-19 emergency.

| € Million | 2019* | 2020 | 202148 | Change % 2020-2021 |

| Distribuited | ||||

| Suppliers | 754.2 | 756.4 | 867.5 | 14.7% |

| Personnel | 258.3 | 266.9 | 267.4 | 0.2% |

| Lenders | 53.0 | 56.4 | 59.5 | 5.5% |

| Shareholders | 207.2 | 243.6 | 252.9 | 3.8% |

| Public Administration | 203.9 | 229.8 | 232.5 | 1.2% |

| Community | 0.7 | 3.1 | 1.3 | -58.3% |

| Withheld | ||||

| Company | 549.6 | 550.5 | 566.1 | 2.8% |

| Total value generated | 2,026.9 | 2,106.7 | 2,247.2 | 6.7% |

* Restated figure. For the value reported in the 2019 Consolidated Non-Financial Statement, please refer to the document published on the Group’s website at https:// www.italgas.it/wp-content/uploads/sites/2/2021/07/Non-Financial-Statement-2019.pdf.

48 The direct economic value generated and distributed includes the financial data of the Ceresa Company.

The Company has defined and approved the principles and guidelines inspiring the Group Tax Strategy, in order to assure capital integrity over time and the transparency of management of the tax variable and risks associated to it.

The Tax Strategy, defined and approved by the Board of Directors of Italgas S.p.A., incorporated by its subsidiaries and disclosed to non-subsidiary affiliate companies, in order to promote awareness and application of the principles and guidelines contained therein, aims to:

The Tax Strategy is inspired by the same principles expressed in the Italgas Code of Ethics, that comprises the set of values that the Group acknowledges, accepts and shares and the responsibilities undertaken both inside and outside its organisation, which constitute the ethical business culture inspiring Italgas’ strategic reasoning and running of its business.

In line with these values, Italgas acts in compliance with applicable laws and the principles of the tax system of the country in which it operates, in order to determine the tax due and the fulfilment of the requirements; in interpreting said laws and principles, it operates in such a way as to responsibly manage the risks connected with the tax variable; it establishes relations with the Financial Administration based on the spirit of collaboration, transparency and good faith, pursuing the objective of developing constructive relations, based on its reliability as counterparty.

The Italgas S.p.A. Board of Directors guarantees the conditions for the implementation of the Tax Strategy, promoting awareness on all levels of the importance that the Group attaches to the values of honesty, correctness and legality in tax.

The Italgas Group’s Tax Strategy can be consulted at the following link: https://www.italgas.it/en/governance/business-ethics/

In order to further strengthen its Internal Control and Risk Management System, the Italgas Group adopted the Tax Control Framework (TCF), which establishes the principles, methodologies, characteristics, operating logics, roles and responsibilities pertaining to the establishment, maintenance over time and functioning of the detection, management and control system of tax risks, as well as the assessment of its constant effectiveness in terms of adequacy and actual operations.

The responsibilities of Italgas’s Departments with respect to the TCF refer to the concept of the “lines of defence”:

The measurement of tax risks, made on the basis of quantitative and qualitative elements, was developed taking inspiration from the company methods adopted as part of Enterprise Risk Management.

For each tax risk detected during the tax risk assessment, within specific control matrices, the measures implemented by Italgas to mitigate such risks are identified and mapped.

The implementation of the Tax Control Framework was functional to the admission, by the Italian Revenue Agency, of Italgas S.p.A. and Italgas Reti S.p.A., on 29 December 2020, into the cooperative compliance set out by Italian Legislative Decree no. 128/2015; intended to reduce the level of uncertainty around tax matters, favouring the prevention of disputes, through forms of continuous and preventive dialogue around situations liable to generate tax risks.

The tax risk assessment and monitoring activities are subject to reporting to the company departments responsible, the corporate administrative and control bodies and the Financial Administration.