The share capital of the Company as at 31 December 2021 consisted of 809,768,354 shares without par value, giving a share capital value of € 1,002,016,254.92.

As at 31 December 2020, based on the shareholders’ list, the information available and the notices received pursuant to Article 120 of the Consolidated Finance Act, the owners of significant equity investments re represented below.

| CONSOLIDATING COMPANY | SHAREHOLDERS | % OWNERSHIP |

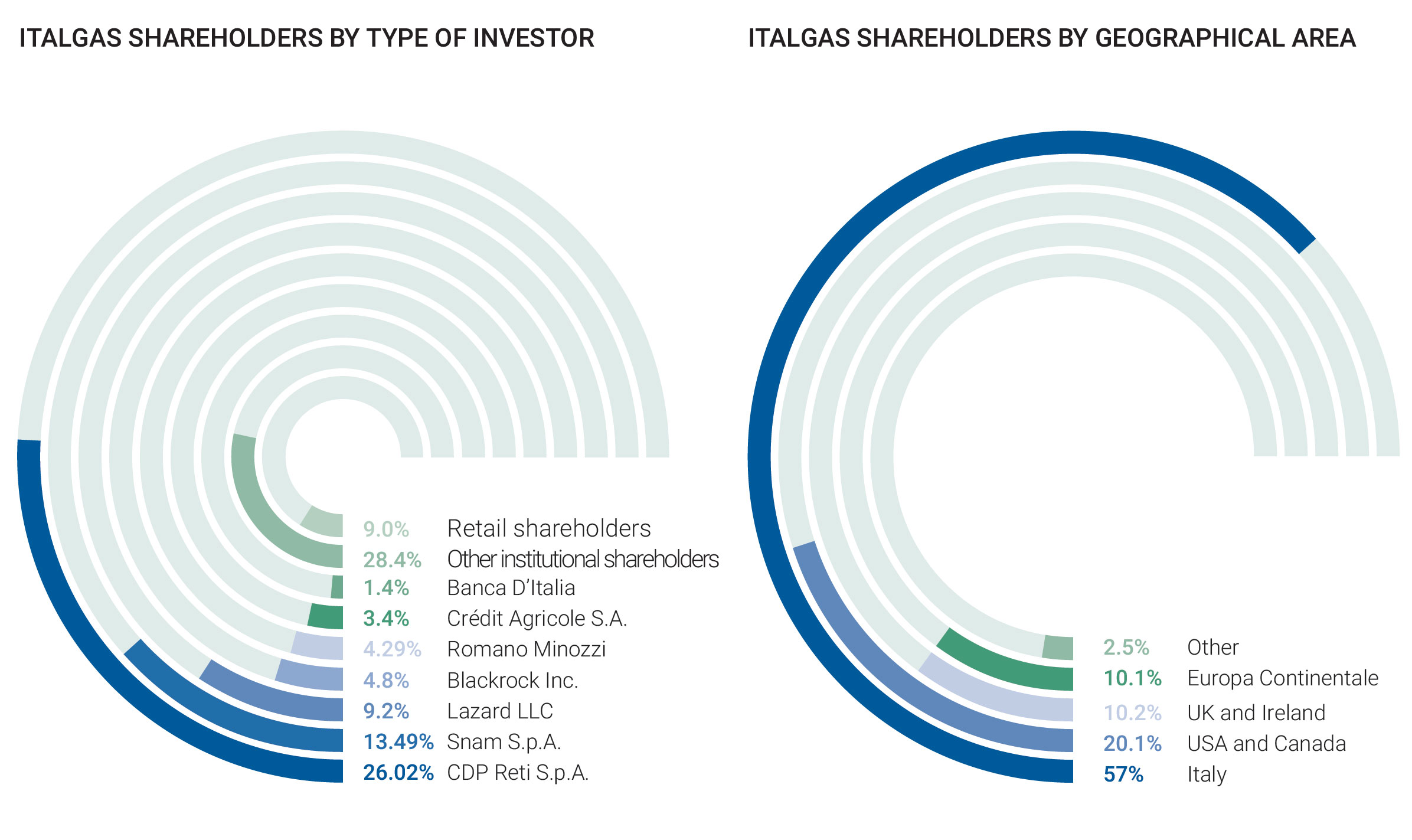

| Italagas S.p.A. | CDP Reti S.p.A. (*) (**) | 26.02 |

| Snam S.p.A. | 13.49 | |

| Lazard LLC | 9.2 | |

| Blackrock Inc. | 4.8 | |

| Romano Minozzi | 4.29 | |

| Crédit Agricole S.A. | 3.4 | |

| Banca D’Italia | 1.4 | |

| Altri Azionisti istituzionali | 28.4 | |

| Azionisti Retail | 9.0 |

(*) On 1 August 2019 the Board of Directors of CDP S.p.A., also with a view to considering the control guidelines contained in Consob Communication no. 0106341 of 13 September 2017, reclassified its equity investment in Italgas as de facto control pursuant to article 2359, subsection 1, no. 2) of the Italian Civil Code and article 93 of the CLF, exercising control through CDP Reti with a 26.05% equity holding and through Snam with a 13.50% equity holding. CDP does not exercise management and coordination activities with respect to Italgas pursuant to articles 2497 et seq. of the Italian Civil Code.

(**) A shareholders’ agreement between Snam, CDP Reti and CDP Gas was signed on 20 October 2016, effective from the date of the demerger of Italgas S.p.A. on 16 November 2016. With effect from 1 May 2017, CDP Gas was merged into CDP. Subsequently, on 19 May 2017, CDP sold to CDP Reti, inter alia, its equity investment in Italgas S.p.A., equal to 0.969% of Italgas S.p.A.’s share capital. CDP Reti is 59.1% owned by CDP, 35% by State Grid Europe Limited – SGEL, a company of the State Grid Corporation of China group, and 5.9% by a number of Italian institutional investors. On 1 August 2019, the shareholders’ agreement was further updated to take account of the aforementioned re-qualification of the shareholding.